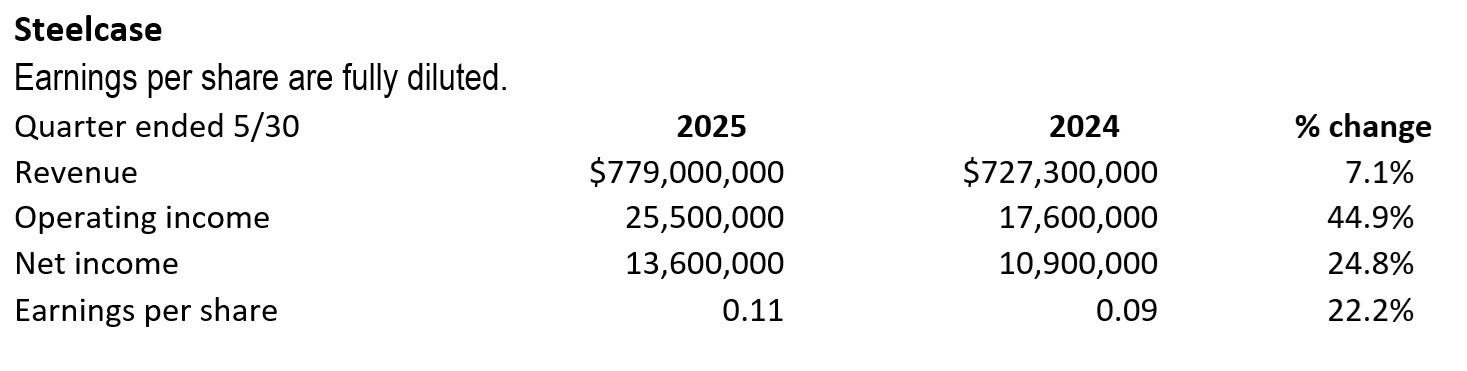

Grand Rapids, Michigan Steelcase reported a strong start to the 2026 financial year, whereby sales increased by $ 779 million in the first quarter, which is largely due to growth in America and ongoing investments by large corporate customers.

The net profit rose to $ 13.6 million or 11 cents per share of $ 10.9 million or 9 cents per share in the same period of the previous year. The adapted result per share reached 20 cents compared to 16 cents in the first quarter of 2025.

“Our results in the first quarter were a big start to the year,” said Sara Armbruster, President and CEO. “We have achieved strong sales growth, led by our large corporate customers who invest to reinterpret their jobs. Since companies bring people together in a new way, they contact Steelcase to create spaces, support the connection, creativity and performance.”

See also:

The turnover in America rose by 9%and reached 603.6 million US dollars, which were heated by a major deficit and greater demand by corporate, government and health sectors. However, the order volume in the region decreased by 1%, with the company orders being compensated for by softness in government and education.

Despite an organic decline, international sales rose by 1% to $ 175.4 million. In India, Great Britain and China, a strong performance was carried out in Germany and France.

The gross margin improved to 33.9%, by 170 basis points compared to the previous year, supported by the cost cuts and an increased volume in America. The operating result rose by 45% to $ 25.5 million, with the adjusted operating result reaching 39 million US dollars.

“In the first quarter, we initiated restructuring measures in America that aims at $ 20 million,” said Dave Sylvester, Senior Vice President and CFO. “This included a reduction in relatives and the removal of open positions. We have also started discussions with unions and work councils in Europe in order to further reduce the costs in response to macroeconomic headwind.”

While America recorded a profit of the adjusted operating profit per year compared to the previous year worth $ 14.3 million, international was a decrease of $ 3.5 million, which was primarily due to a reduced demand from small to marked customers in Germany and France.

The company's deficit at the end of the quarter was around 801 million US dollars and rose by 2% compared to the previous year. Steelcase expects sales between 860 and 890 million in the second quarter, which is flat up to 4% compared to growth in the previous year.

Steelcase expects the adapted result per share to be between 36 and 40 cents in the second quarter, compared to 39 cents in the previous year.

“Our customer calls remain very active, including the latest design days and Neocon events,” said Armbruster. “Many were ready to advance the final design decisions. These interactions increase the trust of our customers in the USA and the relevance of our solutions in a changing world of work.”

The company's board of directors declared a quarterly dividend of 10 cents per share, which was paid on July 21 on July 7 to the shareholders of records.

Steelcase ended the quarter of $ 391.5 million in liquidity and $ 447.3 million. The subsequent four -quarter EBITDA was $ 265.8 million or 8.3% of sales.