Author: Asher, Odaily Planet daily

Yesterday Yunfeng announced Financial, in which Jack Ma indirectly held that the company's board of directors approved the purchase of ETH on the Free Market as a reserve assets. At the time of the announcement, the group Kumulative bought 10,000 ETH on the free market with total investment costs (including fees and expenses) of $ 44 million.

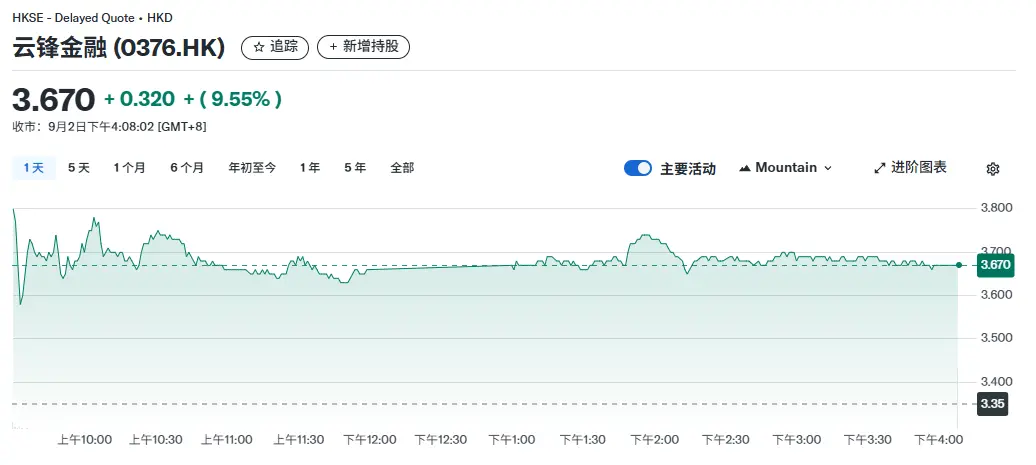

In addition, the use of ETH as a reserve asset with the layout of the group in state-of-the-art fields such as web 3 and can optimize the investment structure, which reduces the dependence on conventional currencies. As a result of this news, Yunfeng Financial (0376.hk) recorded an intra -rist rising of almost 10%.

Yunfeng financial course

Jack Ma and Yung Financial

Yunfeng Financial has always been viewed as a “Jack Ma concept stock”.

The controlling shareholder of Yunfeng Financial is Yunfeng Capital, one of Jack Ma and Yu Feng, the founder of Focus Media, co -founded fund in 2010. The “Yun” comes from Jack Ma, and the “Feng” comes from Yu Feng. According to public data, the founder of Alibaba Jack Ma indirectly holds about 11.15% of Yunfeng Financial via Yunfeng Capital, considers 29.85% to Yunfeng Financial Holdings Limited and holds 40% (without voting rights) in Shanghai Yunfeng Innovation.

Jack Ma and Yu Feng

In addition, the predecessor of Yunfeng Financial can be attributed to Wan Sheng International Securities, which was founded in 1982 and was listed at the Hong Kong Stock Exchange in 1987 and gradually grew into a leading local broker in Hong Kong. In 2015, Jack Ma and Yu Feng Yunfeng Capital prompted to acquire a controlling share for 3.9 billion HKD and to promote the company's transformation. Since then, Yunfeng Financial has built a “Finance + Technology” Ecology Closed Loop by taking over 60% participation in American United Insurance (in 2018) and integrating licenses into securities, insurance and wealth management.

The purchase of Ethereum by Yunfeng Financial is only the beginning

Yunfeng Financial announced yesterday that the Ethereum company started as part of its strategic reserve. This step marks the beginning of the group's layout in the fields of Digital Asset and Web 3, In the future, it will continue to promote the strategic and digital financial innovation of cryptocurrency and examine the inclusion of mainstream token such as BTC and SOL in reserves.

At the same time, the group plans to integrate digital assets deeply into their own business, to examine the tokenization of RWA (real assets) and the potential applications of blockchain technology in core transactions such as insurance and asset management in order to build up a “finance + technology”.

Yunfeng Financial will flexibly adapt the scale of digital asset reserves based on market development, regulatory environment and financial conditions. The group emphasizes that they will continue to accelerate their layout in Web 3 to promote the innovation of financial technologies in order to improve the experience of customer service and financial autonomy.

Strategic investments in Pharos' public chain, which works with Ant Group in the RWA sector

On September 1st, Yunfeng Financial announced a strategic cooperation agreement with Ant Group and at the same time made strategic investments in Pharos' public chain. This cooperation aims to accelerate the integration and innovation of web 3 and traditional finances, whereby the tokenization of RWA (real assets) and the web-3 field is interpreted via the platform of the public chain of pharos.

Pharos project overview

Pharos is a public chain of the next generation 1 that focuses on RWA.

With regard to the performance, the network has a modular design and a high parallelism, whereby the currently started testnet has reached a TP of 30,000 and far exceeds other EVM and parallel networks. At the same time, Pharos occupies an innovative GPU-like architecture and improves storage efficiency by 80%to support billions of users. Pharos' core team not only includes Web -2 experts from the Ant -Group and Alibaba Blockchain, but also experienced experts from the Web 3 industry.

With regard to the financing, Pharos completed a seed round of $ 8 million on November 8, 2024. Under the direction of faction and Hack VC with the participation of SNZ Holding, Hash Global, MH Ventures, Dispersionkapital, generative activities and chorus one.

Second season of the testnet tasks in progress

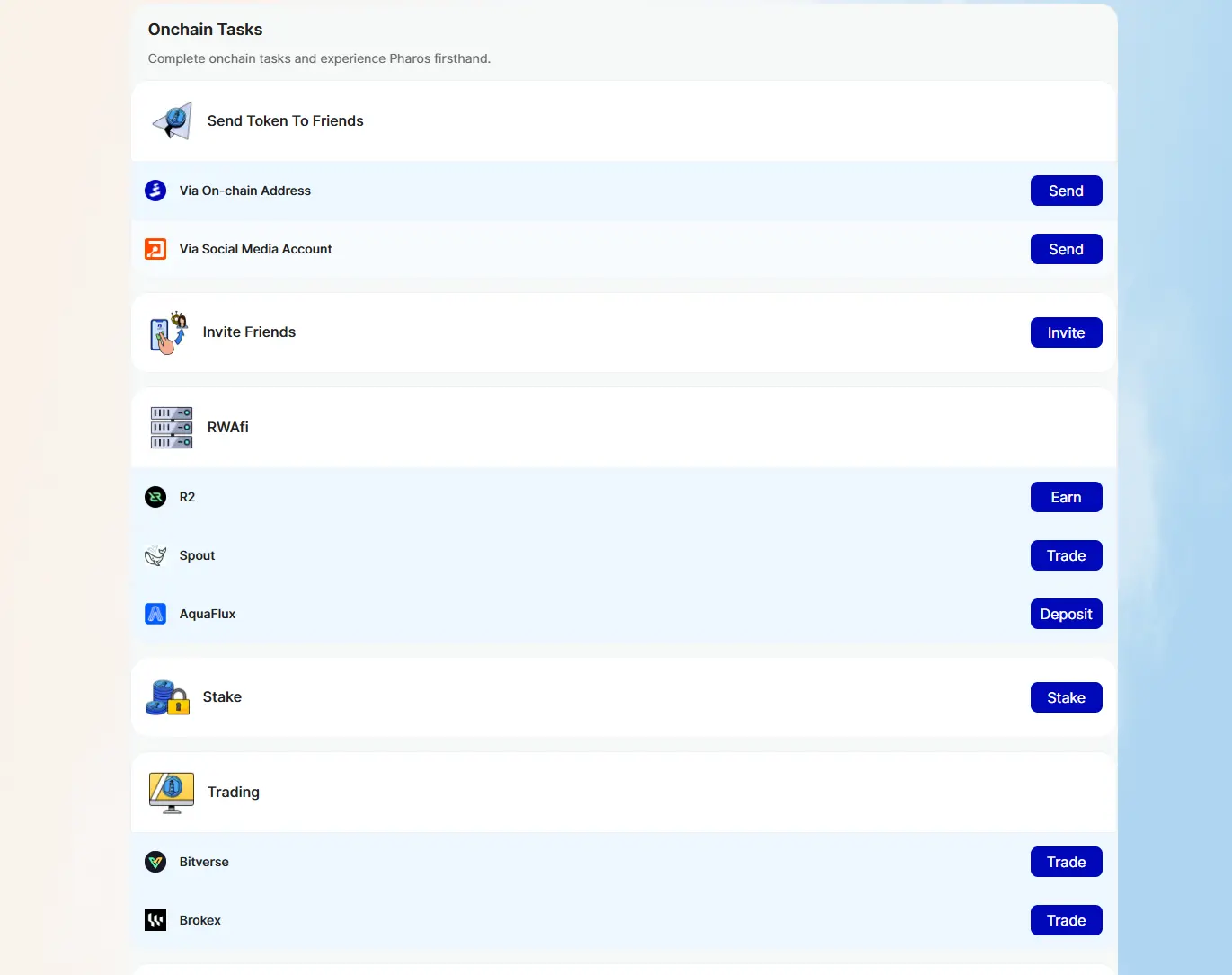

Pharos currently opened the second season of the testnet for early users with specific interactive processes as follows:

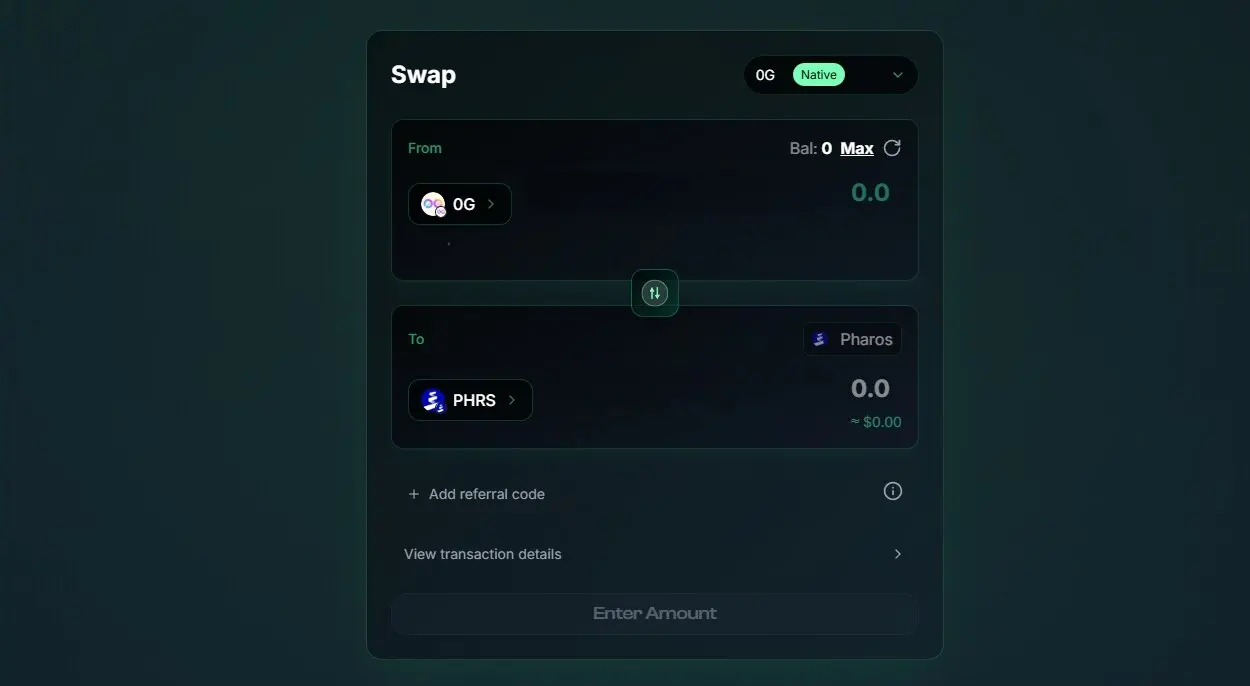

Step 1. Temporary coins, you can first address 0G test coins and replace them for PHRS test coins.

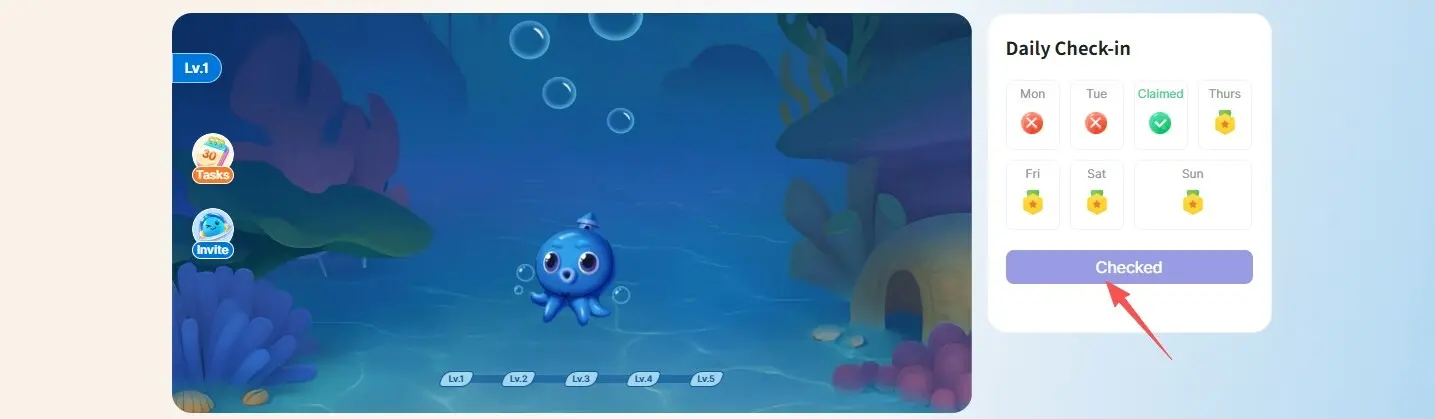

Step 2. Enter the interactive website of the second season, connect your wallet and list the daily checks.

Step 3. Complete Onkain interaction tasks and social tasks as required.

Summary

Yunfeng Financial's strategic layout from Ethereum, in which Jack Ma indirectly holds the shares, not only shows a belief in arising technologies, but also reflects his future -oriented exploration in financial architecture.

From a strategic overall perspective, Yunfeng Financial takes an important step to optimize the company's reserves and reduce the dependency on traditional Fiat currencies by increasing its digital assets. On the other hand, it also tries to deeply integrate traditional financial services into Web -3 technology, in particular the exploration of blockchain application scenarios in areas such as insurance and securities.

With the advantages of Hong Kong in the regulation of digital assets, it is expected that Yunfeng Financial will be an important bridge between traditional finances and the crypto ecosystem. Perhaps for Jack Ma, the purchase of 10,000 ETH from Yunfeng Financial is only the beginning of the web 3 layout – The real digital financial landscape is just beginning to develop.

Click here

Recommended reading:

Regulatory breakthroughs and institutional entry: A review of the decade of the cryptocurrency penetration in Wall Street

Pantera Capital Tegerted analysis: The value creation logic of Digital Asset Treasury Dats

Dialogue with Larry Fink, CEO from Blackrock

Chaincatcher reminds the readers to view blockchain rationally, to improve the risk awareness and to be careful of various virtual token emissions and speculations. All content on this website is exclusively market information or related opinions of the party and do not represent a form of investment advice. If you find sensitive information in the content, please click on “Report” and we will handle it immediately.